Investors are Interested and Taking Notice of the Recycled Composites Business

- Ned Patton

- Sep 30, 2025

- 6 min read

I have talked in this space about composites sustainability, recycling of composites, new plant-based fibers and resins, and how the business of composites not only needs to change but is in the midst of a transition toward a more sustainable and carbon neutral industry. And I have also talked about how the industry needs to find investors to help speed the “greening” of the industry. I’ve even highlighted some of not only the startup companies recycling composites but also where they are finding markets for their recycled product.

So, it really did not come as much of a surprise to me that investors are now jumping into the composite recycling business in a large way. There are news pieces in Composites World that have featured several of these investments, and JEC World in March of this last year actually had an entire day focused on investors in the composites business. This “Investor Day” was quite successful and they plan on having another one in 2026 at JEC World in Paris.

The lead image in this post is from Yannick Willemin, President of Catalysium which is a consultancy in Zurich that helps startups in the high performance composites business find investors. He wrote an article in Composites World (1) about the fact that the Investment Community is starting to take notice of sustainable composites and the recycling of end-of-life composites.

Apparently after Yannick posted on LinkedIn about carbon fiber recycling and where that industry was going, he got a very robust response from several big names in the European investment community either already invested in this space or asking how they can participate. The questions asked were about “Where is this ecosystem going?” as well as “How can we be a part of it?”

The way I read this article and the fact that JEC World had a very successful Investor Day in 2025 which is being repeated in 2026 (2) is that the Investment Community sees great upside potential in this market, especially in Europe.

The reasons for this are fairly obvious to those of us that have been watching this industry for several years. Composite materials, especially carbon fiber composites, are coming down in cost rather dramatically while either maintaining or enhancing performance. The fact that they are now an integral part of most industries when high performance materials are required to remain competitive in their markets drives the need for composites across the board. And the fact that they are difficult to take apart and there are not enough different means of dealing with them at the end of their useful lives makes the burgeoning composite recycling marketplace ripe for significant investment and scale up.

In Europe, with the new environmental regulations that ban landfilling of things like used wind turbine blades and boat hulls, along with other things made using composites, the composite recycling business is rapidly expanding to meet the need. I have written extensively in these newsletters about European companies like Composite Recycling, Fairmat, ECR Technology, SGL Carbon, and more that seem to be added to the list frequently.

Most of these companies have been able to go out to the venture fund market to secure funding to scale up their technologies. Now it appears that the investment market is coming to them asking how they can get involved.

Here in the US this market is just getting started, but it is also a burgeoning market and companies like Vartega, Mallinda, and Continuum are not only successfully recycling primarily end of life carbon composites, they are finding markets for their recycled products and are actually starting to make a profit in their businesses.

As for growth rate, in an article on LinkedIn, Data Horizon Global predicts that the United States carbon fiber composites recycling technology market which was valued at $.25B in 2022 is projected to reach $1.0B by 2030 which is a compound annual growth rate of 19.5% from 2024 to 2030 (3). And in another post in “MarketsandMarkets™” the recycled carbon fiber market in the United States will reach $310M by 2030 from $160M this year. This represents a 13.3% compound annual growth rate. While these are different forecasts, these are the sorts of numbers that investors usually take notice of.

This article in MarketsandMarkets™ talks about the drivers of increased demand for carbon fiber, the restraints imposed on the recycling and reuse of EOL carbon fiber composites which are primarily technical, the opportunity that the recycling of these EOL materials presents – especially if they can be reused in new Type III hydrogen fuel tanks for the transportation industry, and the challenges to accomplishing this which are largely technical as well because most recycled carbon fiber comes in a chopped up form because that is the only technology that has been proven and that is being scaled up.

So, that’s the story about this business and what investors are really looking for. There is tremendous interest in this business and there are ongoing investments in startups that are beginning to demonstrate the ability to recycle these materials at scale. There is also tremendous opportunity for those companies or organizations that develop means of recycling carbon fiber and even glass fiber composites while maintaining the integrity of the continuous fibers. Once we get to that point in this business, which is going to happen in a very short span of time because of the enormous interest in this, the industry can finally become a sustainable, carbon neutral, circular industry.

That’s about it for this week’s post. As always, I hope everyone that reads these posts enjoys them as much as I enjoy writing them. I will post this first on my website – www.nedpatton.com – and then on LinkedIn. And if anyone wants to provide comments to this, I welcome them with open arms. Comments, criticisms, etc. are all quite welcome. I really do want to engage in a conversation with all of you about composites because we can learn so much from each other as long as we share our own perspectives. And that is especially true of the companies and research institutions that I mention in these posts. The more we communicate the message the better we will be able to effect the changes in the industry that are needed.

My second book, which may be out in the late fall but more than likely early next year, is a roadmap to a circular and sustainable business model for the industry which I hope that at least at some level the industry will follow. Only time will tell. At least McFarland announced it in their Fall Catalog. And this time it is under a bit different category – Science and Technology. Maybe it will get noticed – as always that is just a crap shoot.

As I have said before, my publisher and my daughter have come to an agreement about the cover. So, I’ve included the approved cover at the end of this post. Let me know whether or not you like the cover. Hopefully people will like it enough and will be interested enough in composites sustainability that they will buy it. And of course I hope that they read it and get engaged. We need all the help we can get.

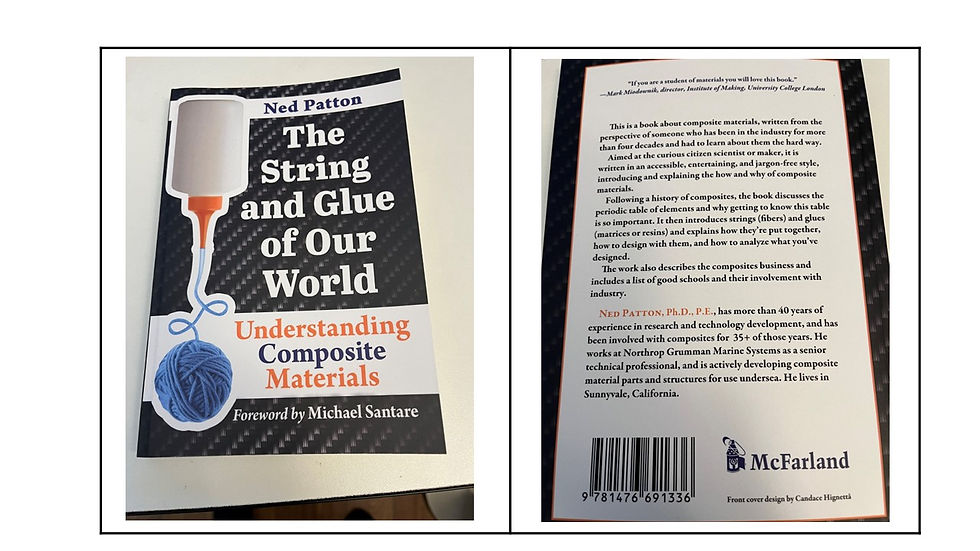

Last but not least, I still need to plug my first book. “The String and Glue of our World” pretty much covers the watershed in composites, starting with a brief history of composites, then introducing the Periodic Table and why Carbon is such an important and interesting element. The book was published and made available August of 2023 and is available both on Amazon and from McFarland Books – my publisher. However, the best place to get one is to go to my website and buy one. I will send you a signed copy for the same price you would get charged on Amazon for an unsigned one, except that I have to charge for shipping. Anyway, here’s the link to get your signed copy: https://www.nedpatton.com/product-page/the-string-and-glue-of-our-world-signed-copy. And as usual, here are pictures of the covers of both books.

(3) https://www.linkedin.com/pulse/united-states-carbon-fiber-composites-recycling-technology-hh3ef/

Comments